Paycheck calculator with new w4

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Get Your Quote Today with SurePayroll.

Understanding Your W 4 Mission Money

Free salary hourly and more paycheck calculators.

. Ad Generate your paystubs online in a few steps and have them emailed to you right away. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Total annual income Tax liability.

Payroll management SoftwareThat Ensures all Employees are paid on time. Figure out which withholdings work best. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks.

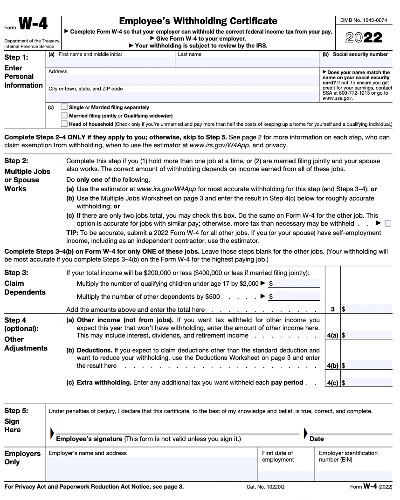

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use our W-4 calculator.

Create professional looking paystubs. New York Paycheck Calculator. All Services Backed by Tax Guarantee.

Ad All Payroll Services in One Place. Free 2022 Employee Payroll Deductions Calculator W-4 with Exemptions Use this calculator to help you determine the your net paycheck. Paycheck based W-4 Estimator Creator.

Enter your new tax withholding. Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section. Or keep the same amount.

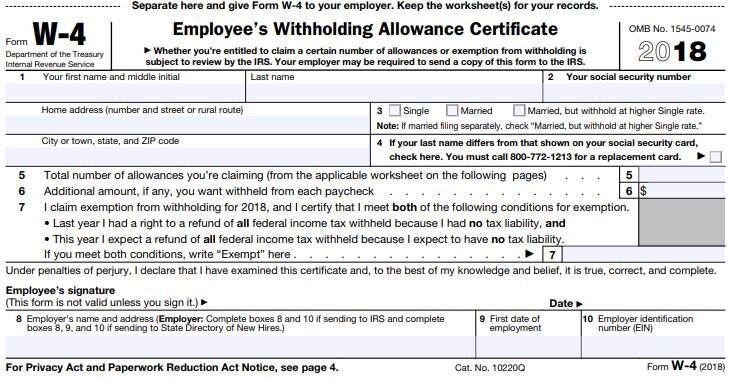

For example you can have an extra 25 in taxes taken out of each paycheck. Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section P163 you will see your per paycheck tax withholding. This calculator uses the old W-4 created before the.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. To change your tax withholding amount. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

Simply enter their federal and state W-4 information as well as their. We use the most recent and accurate information. Use your estimate to change your tax withholding amount on Form W-4.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Started Today with 1 Month Free.

Just enter the wages tax withholdings and.

Home Nextadvisor With Time Irs Taxes Smart Money Debt Management

Step By Step Guide For Filling Out A W 4 Form Workest

What Is A W 4 Form How It Works Helping Your Employees Complete It

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

W 4 Form Basics Changes How To Fill One Out

A New Form W 4 For 2020 Alloy Silverstein

New W 4 Tax Form Explained 47abc

Calculate Or Compare 2019 Or 2020 W 4 Results With The Multi State Calculator

W 4 Form What It Is How To Fill It Out Nerdwallet

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Warning To All Employees Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You Greenbush Financial Group

W 4 Form Basics Changes How To Fill One Out

Paycheck Tax Withholding Calculator For W 4 Tax Planning

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form